Source: Roy Morgan Single Source (Australia), October 2015-September 2016, n=11,984. NB: Aussie Farmers Direct measured since July 2016

During the 2015/2016 financial year, Australian grocery buyers made more than 2.5 trips per week to supermarkets, or a whopping 1.95 billion trips for the year, the recently launched State of the Nation Retail Spotlight from Roy Morgan reveals. And despite the ever-increasing popularity of online retail, the vast majority of us continue to do our grocery shopping in-store rather than online. It seems that buying groceries via the internet is an appealing idea rather than a reality for most consumers.

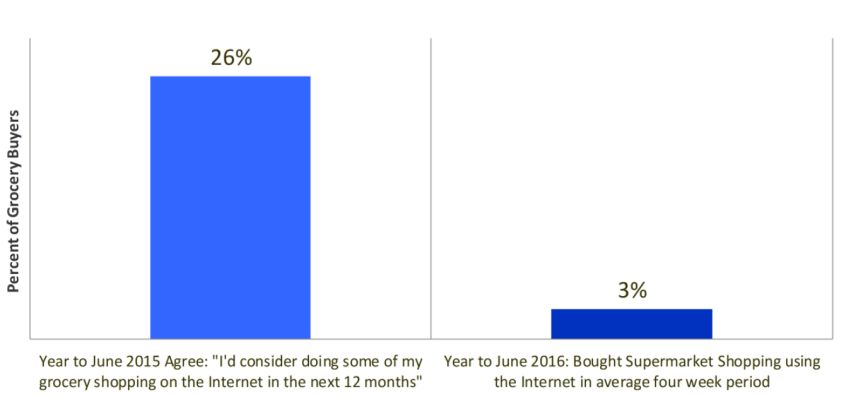

It’s not that grocery buyers actively dislike the idea of doing their supermarket shopping online: in the 12 months to June 2015, 26% of them agreed that ‘I’d consider doing some of my grocery shopping on the Internet in the next 12 months’. So what happened in those next 12 months? Just 3% of grocery buyers did their supermarket shopping in any given four-week period.

Grocery shopping online: it’s still not happening

Source: Roy Morgan Single Source (Australia), July 2014-June 2015 (n=12,923) and July 2015-June 2016 (n=12,110). Base: Australians 14+ who are grocery buyers

Admittedly, this is an increase on 2011 (when it was 1.4%), but it’s unlikely there will be a mass exodus to online grocery shopping any time soon.

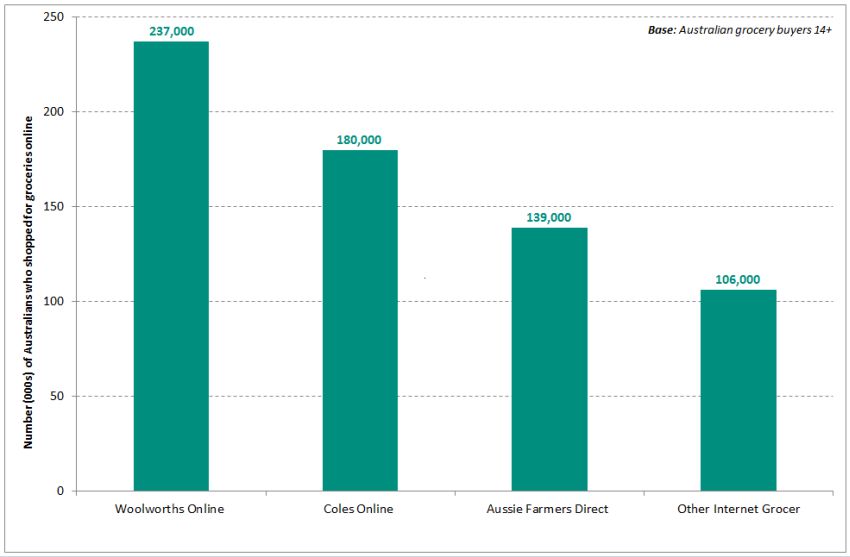

Still, with online delivery service Aussie Farmers Direct having launched a ‘full supermarket shop’ service earlier this year (with which they intend to directly compete with Coles and Woolworths), this will be an area to monitor in coming months. Currently, almost 140,000 consumers say they mainly or sometimes shop with them, or have done so in the last four weeks; not far behind Coles Online (180,000 shoppers). However, both have a way to go before they catch up with Woolworths Online (237,000).

Online grocery shopping numbers of consumers who mainly or sometimes buy groceries via the Internet, or have done so in last 4 weeks

Source: Roy Morgan Single Source (Australia), October 2015-September 2016, n=11,984. NB: Aussie Farmers Direct measured since July 2016

Then there are the other players in this space: such as the CatchGroup-owned GroceryRun, which focuses on dry goods rather than fresh groceries; Indo-Asian Grocery Store, offering online grocery shopping with an international flavour; and numerous smaller, locally-based businesses. Between them, they attract 106,000 customers in an average four weeks.

Michele Levine, CEO, Roy Morgan Research, says:

“The great disparity between the proportion of grocery buyers who say they’d consider doing their supermarket shopping online in the next 12 months, and the proportion who actually go on to do so, speaks volumes about the state of online grocery shopping in Australia. While consumers are clearly not opposed to the idea, they seem to be having trouble putting it into practice.

“One of the great things about online shopping in general is its convenience, but when it comes to groceries, this isn’t necessarily the case. What with all the scrolling, searching for products by key words rather than spotting them on the shelves, being organised enough so you know exactly what you want rather than grabbing items as you see them, it can be quite a challenge!

“But with the rumoured entry of US e-commerce colossus Amazon into Australia, will consumers be converted to online grocery shopping once and for all? Speculation is already rife about the ramifications of an Amazon expansion Down Under, with the local grocery market (both online and in-store) being just one retail sector that stands to be disrupted. It will also be interesting to track the success of Woolworths’ recently announced partnership with Australia Post to install more than 500 parcel lockers for their ‘Click-and-collect’ services, providing an extra 24/7 delivery option for their online customers.

“As our latest State of the Nation report reveals, there were some significant shifts in Australian retail last financial year, with supermarkets and other grocery retailers seeing their fair share of change. No doubt, the coming 12 months will bring even more developments. Whether a move to online grocery shopping is one of them remains to be seen…”

Subscribe to our free mailing list and always be the first to receive the latest news and updates.