Norway avoided charging ‘on the go’ bottlenecks – will the UK?

Norway, one of the earliest consumer markets to embrace electric vehicles has steadily increased the number of passenger vehicles registered as either battery electric (B.E.V), plug-in hybrid or full hybrid over the last decade. In 2021 almost 65% of new passenger vehicles sold in Norway were electric; in addition 22% were plug-in hybrids. In other words, only 14% of new cars sold in Norway in 2021 were sold without a plug. (EV Association, 7th January 2022, TIME magazine).

It took Norway 10 years to get from 1% to 65%. Given that the fuels value chain took over 100 years to develop and is still developing, this is clearly a relatively fast progression. However, as OEMs switch to all electric strategies, new marketing campaigns limber up and exciting new EV models flood showrooms, by comparison with the experience other countries look likely to have, this may look like a snail’s pace. While Norway took 2.5 years to move from 2% to 10% market share, the UK took 1.5 years and Germany only 12 months. (EV Association, 7th January 2022, TIME magazine).

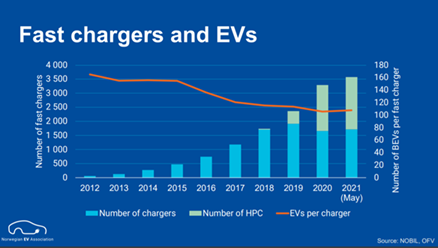

This ten years of steady methodical, EV growth has given Norway time to develop and expand its charging infrastructure network and perhaps for this reason, Norway has yet to experience any significant charging ‘on the go’ bottlenecks in its drive towards the eventual removal of ICE registrations. The below data, kindly provided by the Norwegian EV Association, shows how this transition has been carefully managed and that, over time, investment in the Norwegian charging network has continually improved the ratio of chargers to EVs over time, as shown in the orange line.

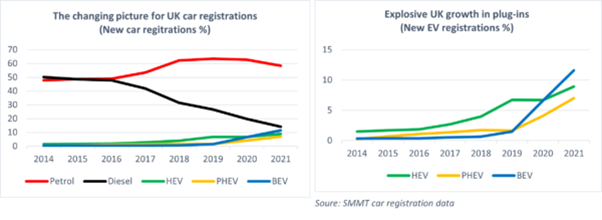

In EV market share, the UK is now at the point Norway reached in 2015. Society of Motor Manufactures and Traders data for the UK shows that in 2021 25% of new vehicles registered came with a plug. This data appears to show that the UK is now on a much faster growth track by comparison to Norway. SMMT car sales figures also for 2021 show that UK drivers purchased more EVs in the last year than in the previous 5 combined.

The UK public charging network may not currently be capable of supporting such a sudden increase in demand for ‘on the go’ charging, with the SMMT themselves suggesting that the charging industry is not receiving enough investment to match the growing demand. Analysis from the SMMT reveals that the ratio of cars to chargers fell by 30% in 2020, suggesting that for this year, with even higher sales, the position will deteriorate even further. Currently, for every new charging station built in the UK, 52 new EVs are registered!

There are signs that this inconvenient picture for EV drivers may be changing. The UK’s Motor Fuel Group (MFG) recently committed to install 350 ultra-rapid chargers at 60 hubs in 2022 and £400 million in EV infrastructure by 2030, representing a very impressive development.

This situation for markets like the UK appears even more concerning given the fact that 95% of Norwegian respondents have their own parking spot and are much more able to charge their homes at home, or in a shared garage (Norwegian EV Association’s Driver Survey, 2020). By comparison, far fewer UK EV owners will be able to charge at home, due to a greater population density and a heavy reliance on on-street parking in many urban areas. If UK EV registrations increase at the same rate as they have over the last two years, it is very likely that a UK charging ‘on the go’ bottleneck will be reached without further industry, or governmental involvement to support the growth of a robust charging network across the country.

This is of course an international issue too. The International Energy agency estimates that $90 billion of yearly investments will be required to build 40 million new charging points globally, (currently 1.3 million exist) to help meet the growing charging needs created by the upsurge in EV sales. This is worsened by the fact that of the 1.3 million, not all are available. A Volkswagen survey in China suggested that chargers were often blocked by traditional ICE vehicles, resulting in only 40% of chargers being available.

UK Plug-in growth is driven by rural and sub-urban residents

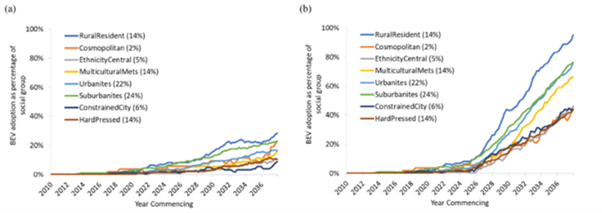

Research undertaken by Rachel Lee and Solomon Brown suggest that rural Britons will adopt EVs faster than their urban equivalents, suggesting that the availability of home charging is already a significant influence on EV adoption, with ~80% of rural residents having access to charging at home, due to dedicated off street parking being far more commonplace than in urban areas.

Rural dwellors are closely followed by UK suburbanites, and it is likely that these two groups, despite only representing 38% of the total UK population will account for a far larger quantity of EVs per capita. Of course, EV adoption will also rely on future price comparisons. If EV prices fall, in line with Bloomberg’s prediction that the upfront cost of EV’s will be competitive without government subsidies by 2024, it will substantially increase EV adoption rates, alongside an increasing second-hand UK EV market creating a trickle-down system to integrate electric vehicles into low-income populations.

However, given the approaching UK charging ‘on the go’ bottleneck, UK EV growth could potentially stall amongst urban populations once the rural and sub-urban earlier adopters have entered the plug-in market.

Growth of EV adoption amongst various UK demographics, (a) showing predicted growth along current price lines, (b) showing growth if prices drop according to bloomsberg’s 2018 predictions. Source Lee & S. Brown

Will real world charging anxieties and fleet driver behaviours make a difference?

Research done by Schluz and Rode from data provided by NOBIL (a database of charging station information), focuses on range anxiety and charge time as two of the most signficant barriers consumers face when considering EVs. According to Schulz and Rode, this is due to the comparable drop in range gain after one recharge compared to refueling alongside the extended time taken to charge.

If this decreases the perceived relative advantage of EVs, the creation of a consistent and regular charging network can help alleviate these concerns. Range anxiety, of course, is often psychological as opposed to real, with many UK motorists driving less than 40 miles a day, far below the amount needed to leave commuters stranded between charging stations, but as it is a clear issue amongst those polled, it must be addressed none the less.

Fleet driver behaviours also need to be considered in this context. Fleet vehicles are converting over to plug-in vehicles at a very rapid rate. Anecdotal evidence suggests that fleet drivers are far less likely to charge at home, (even when able to) and therefore rely much more on charging ‘on the go’ options. Because charging on the go opportunities are often currently far less convenient and reliable than for re-fueling ICE vehicles, vehicle range is often further constrained in real world situations.

EV fleet drivers will rarely allow their vehicles to go below 20% of battery level. Equally, as they are time constrained when charging on the go, they also often only charge up to 80% of battery capacity. This effectively cuts the total effective range by 40%. This is, of course, compounded by slow charging times, with the most commonly found charger only providing 8km of range per hour charged, and higher speed chargers often being unavailable, or too few in number. Tesla now suggests optimal routes via its charging stations on long-distance trips and most EV drivers now adopt this kind of careful route planning to trips.

What is certainly clear in many nations, is that charging networks often do not yet exist in the required strength or scale needed to support future EV populations. Countries like Norway which have developed and continued to invest in the expansion of efficient, high-speed networks will see continual EV sales growth, whereas those that fall behind will reach natural bottlenecks as charging demand outweighs available supply. It is vital that better solutions are achieved through a combination of private and government investment to ensure stress-free regular charging.

Subscribe to our free mailing list and always be the first to receive the latest news and updates.